Why commercial real estate needs to be part of your portfolio

Direct real estate investment also offers a number of benefits, including, but not limited to, stability, portfolio diversity, cash flow and appreciation. Below is a closer look at some of the top reasons that commercial real estate is attracting a broader investor audience to the sector.

Grove Central Miami

1. Attractive returns: – One of the main reasons that institutional and private investors alike are pursuing real estate investments right now is that they are chasing yields. Real estate returns are attractive compared to alternatives in stocks, bonds or even other commodities such as gold. One benchmark for measuring investment performance for a large pool of individual commercial real estate properties in the private market is the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index, which measures the performance of an immense pool of individual commercial real estate properties on an unleveraged basis. The NCREIF Index reported an annual return of 12.7% in 2015, which bested other key indexes such as the S&P 500, Dow 30 and Russell 2000. On a longer-term view, the NCREIF Index has reported an average annual return of 8.8% over the past 15 years, which is 200 basis points above the average performance of the S&P 500 for the same period.

2. Cash flow: – Real estate investments are often structured to deliver steady cash flow with dividends that are distributed to investors monthly, quarterly or annually. The two main options for investors are to make either an equity investment or a debt investment. Equity investments involve buying a passive, minority ownership stake in a hard asset, such as an apartment community or office building. High occupancies and rising rents generally deliver what most owners/investors strive for – steady or rising cash flow over time. Debt investments refer to investing in a real estate loan. Those loans are backed by an underlying asset as collateral, such as land or a building. One of the advantages of debt investments is that they are generally structured to deliver a fixed return.

3. Equity upside: – Specific to equity investments, investors have the opportunity to boost their overall return by cashing in the property appreciation or a capital gain on an asset once it is sold. Property values certainly rise and fall during market cycles, which makes timing the exit strategy a critical aspect of maximizing investor value. Some investors can reap the rewards of opportunistic buys that allow them to buy, fix and flip an asset in a relatively short period, such as one to three years. Other investment strategies, more predicated on the prospect of stable cash flows, might target a hold period of five to seven years or longer.

4. Depreciation: – While realizing appreciation and capital gains is a definite incentive to real estate ownership, there also is depreciation on the other end of the spectrum. Depreciation decreases the accounting value of the physical structure of a real estate asset, as most assets decline in value over time, but does not affect the market value of a property. In its most basic form, the physical improvements of a property may be depreciated over a 27.5-year period in an accounting method referred to as “straight line depreciation”. However, certain improvements (e.g., appliances and flooring) may be depreciated over a period as short as five years. Depreciation is utilized by real estate operators as a tax benefit tool, which allows an investor to utilize a passive “loss” from depreciating improvements to offset other passive income. The net result is a higher after-tax yield. As the tax benefits of depreciation are dependent upon an individual’s or entity’s taxable income, investors are strongly encouraged to consult a tax advisor.

5. Principal Paydown: – For assets that are mortgaged with a fully amortizing loan, the property’s revenues service an outstanding debt that reduces with each month’s payment. Think of it as a monthly savings program – the rents paid by a property’s tenants reduce the asset’s leverage, which in turn, increases equity and, hence, investor returns at the point of exit (which at 75% leverage can amount to 25% of total returns) while also reducing risk. In a world of investment uncertainty, principal paydown infuses an element of month-over-month certainty of returns.

6. Tangible assets: – Another key advantage of real estate investing is that it is a good way to diversify portfolios that are backed by hard assets. Real estate is not the same as buying shares in a company that may be here today and gone tomorrow. Certainly, cases such as Enron and Lehman Brothers have proved that even stalwart corporations are not infallible. Real estate is an asset class that investors can literally touch and feel. Commercial real estate offers a number of unique attributes as an investment. There are many investments that can provide a descent return and a sense of safety in the investment world and there may be ups and downs in building valuations over the course of its life, but the property itself is not going to disappear.

Ready to Build a Real Estate Portfolio?

Here are a few questions that you should ask as you are evaluating your investment opportunities:

1. What are the anticipated levels of return on the investment? –You must look at the numbers when determining the right strategy. When you analyze the data, it helps you to avoid the common mistake of moving forward on unrealistic expectations. You know the risk; you know the upside… now you can decide if you are willing to put your money into the deal.

2. What is the relativity to other asset classes? – Also, consider the amount of money that you are willing to put into the real estate investment. Be careful to avoid under- or over-allocating funds to one specific asset class.

3. How does real estate investing fit in my bigger portfolio? – Smart investors know the balance and anticipated return on their full portfolios. Even though there are never guarantees when it comes to investing or market trends, you can look at the relative possibilities available in the future. Look to experienced and respected players in the industry to shape a strategy that keeps your money diversified and productive.

3. Is there a right way to get started with real estate investing? – Like anything else, there is a right

way and wrong way when you are ready to diversify with private equity real estate. Diversification is a safer bet when it comes to achieving your investment goals. Also, you can give yourself an edge in the industry by tapping into the expertise offered by a team that knows the right strategy. There’s no reason to “reinvent the wheel” when effective real estate investing strategies are already in place.

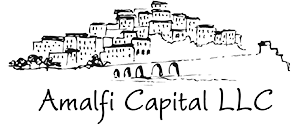

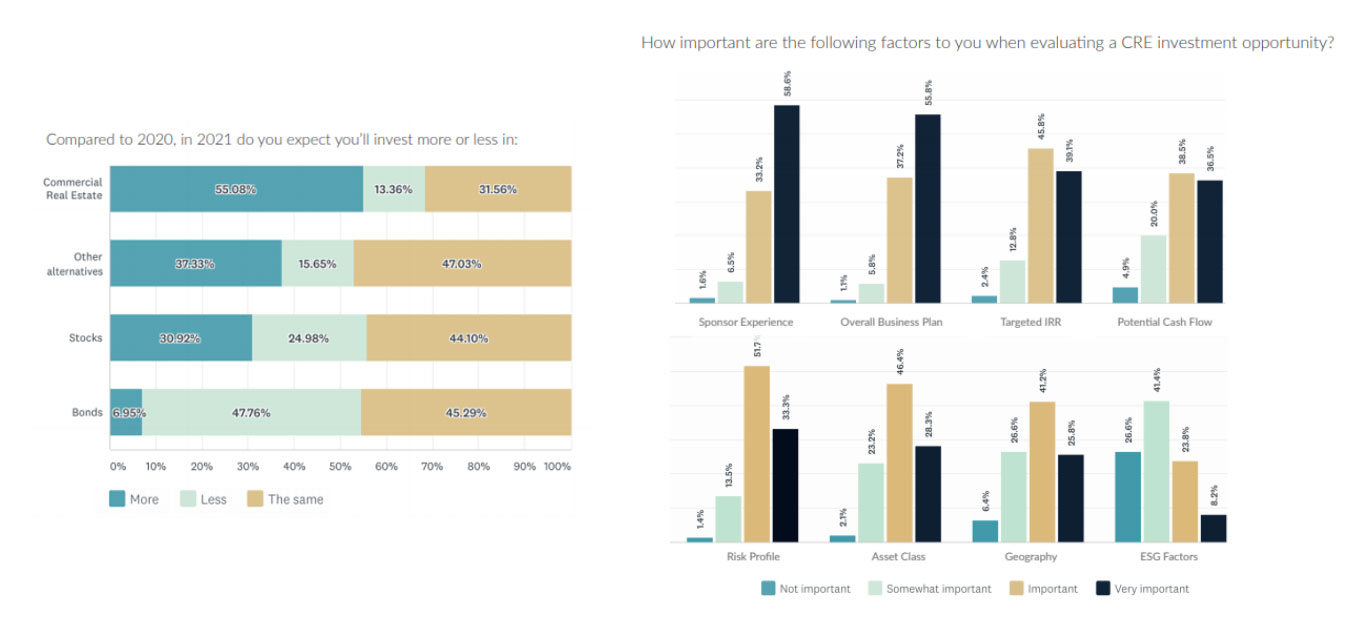

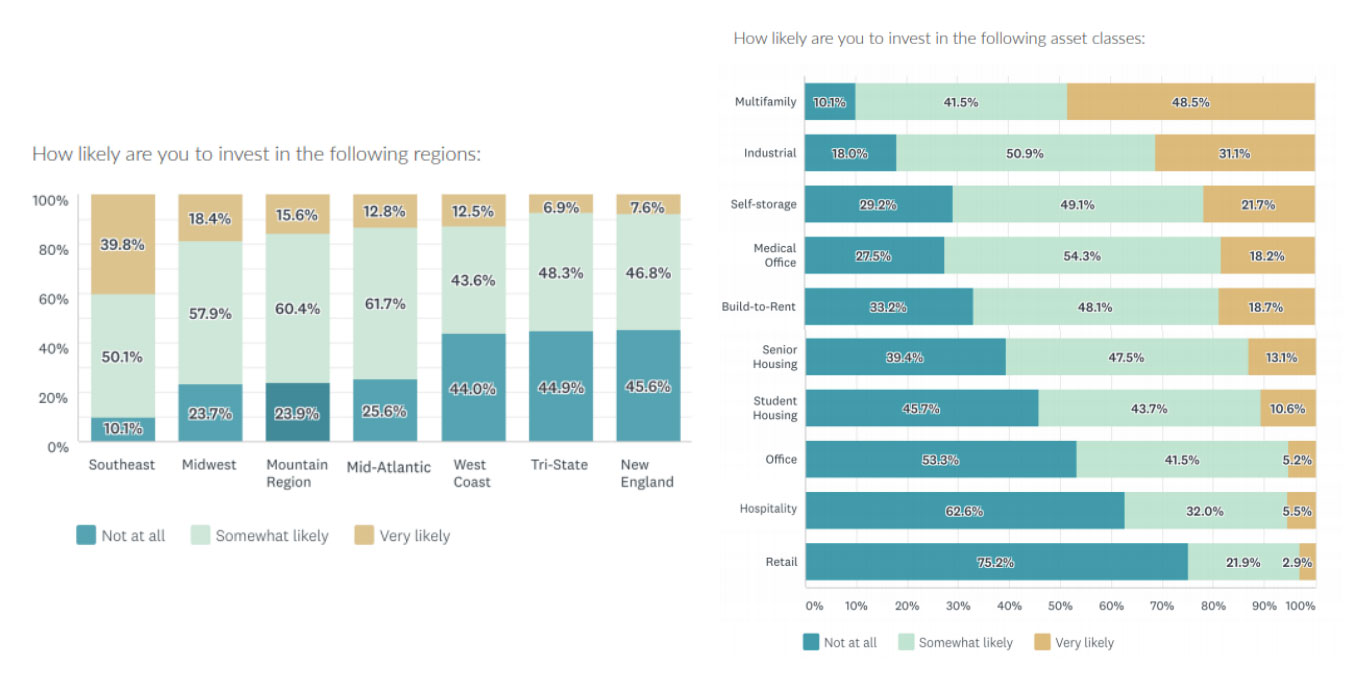

A recent survey by CBRE asked potential real estate investors the following questions:

Amalfi Capital is a real estate equity firm founded in 2015 that is an investor in over 1 million square feet of property with a gross value over $125 million throughout the United States. Amalfi focuses on expanding its portfolio by acquiring residential, commercial, & industrial assets that we believe are well positioned for above market returns over the long run. AmalfiCapitalinfo@gmail.com