For Immediate Release – Boca Raton, FL – October 24, 2024

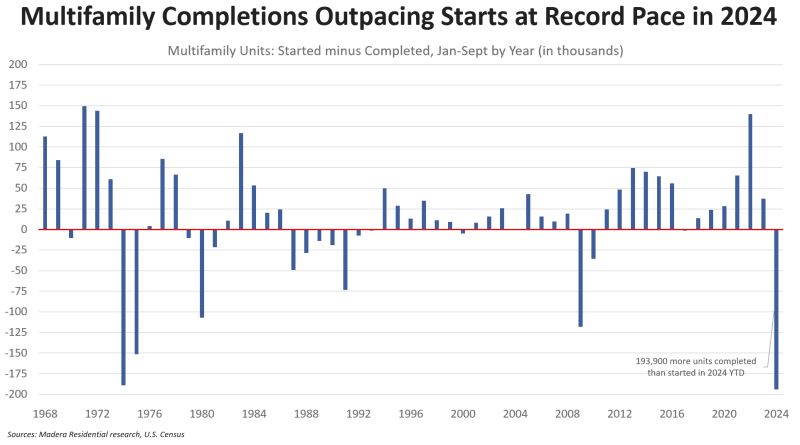

This continues to be one of the most important charts you’ll see on the direction of the U.S. apartment market, now updated with September data released today. Multifamily starts trail completions by the widest gap in recorded history through the first nine months of 2024.

We completed 193,900 units more than we started so far in 2024, according to U.S. Census data released today.

It doesn’t take an economist to figure out what that means.

Right now in 2024, renters are experiencing the benefits of peak supply. Apartment rents are flat or falling across most of the country. Some are even moving to newer, nicer apartments at lower or comparable rents compared to what they paid previously.

But the completions > starts trends continue to point to significantly reduced supply in late 2025 and into 2026 (and likely further). That would likely put upward pressure on rents again.

Obviously, this is no secret these days. Every GP and developer is trying to raise capital using data like this, but execution is much harder than strategy. Particularly on the development side, it’s very difficult to see a scenario — barring some type of unprecedented epic shift — where supply returns to these levels.

*****************************************************************************

Amalfi Capital is a real estate equity firm founded in 2015 that is an investor in over 5 million square feet of property throughout the United States. Amalfi focuses on expanding its portfolio by partnering with highly experienced sponsors who are experts in their respective markets by investing in commercial & industrial assets that we believe are well positioned for above market returns over the long run. Our conservative approach combined with markets and properties that have historically high occupancy, such as our concentration on multi-family, industrial distribution & flex space facilities, has been a winning formula since our inception. www.Amalficapital.biz