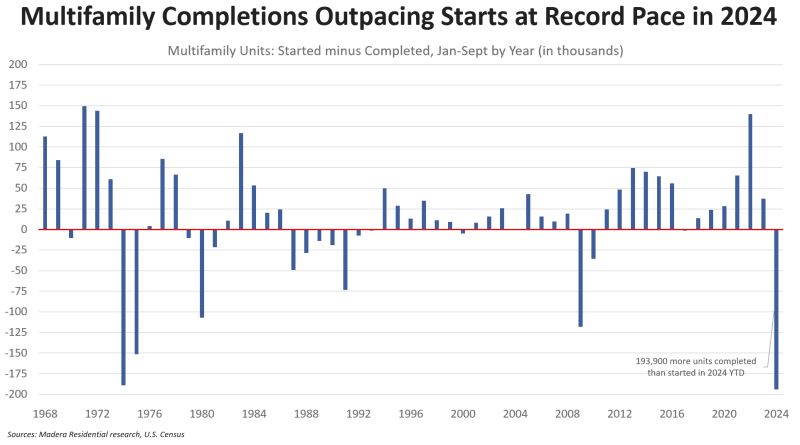

Multi-Family Starts Hit Record Low

For Immediate Release – Boca Raton, FL – October 24, 2024 This continues to be one of the most important charts you’ll see on the direction of the U.S. apartment market, now updated with September data released today. Multifamily starts trail completions by the widest gap in recorded history through the first nine months… Continue reading Multi-Family Starts Hit Record Low