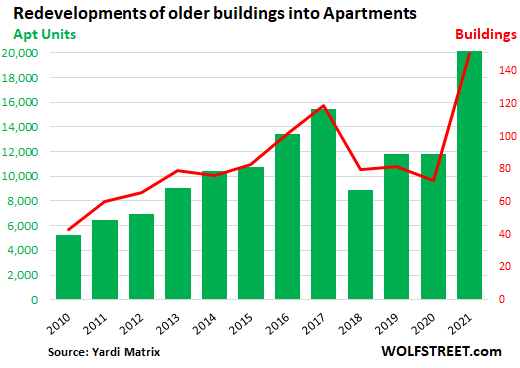

Only 3,575 apartment units were converted from office space in 2022. The already tough process now faces even more challenges.

Cities hoping to convert emptying office buildings into apartments are running into 20-year high interest rates, reluctant banks, stagnating rental markets, ever expanding permit issues, and other challenges that are bottling up their efforts.

Developers last year created just 3,575 apartment units in the U.S. through office conversions, according to an analysis by rental listing site Rent Cafe. That amounts to less than 1% of all apartments built that year through new construction.

Federal and local governments are trying their best to give conversions a much- needed boost. The White House said last month that it was updating guidance for existing grants and spending programs to make billions in federal dollars available for these projects. It also said it would seek the conversion of more government-owned properties into housing. In some cities such as Washington, D.C. tax incentives and faster approvals are “rocket fuel” for these projects, but getting approvals and funding from banks remain a huge obstacle. The problem to begin with is less than 1% of office space in the biggest U.S. cities are candidates for residential conversion to begin with.

In significant ways, the conversion process is getting even harder now. Slowing rent growth might make apartment conversions less attractive to investors, if the trend persists into next year. Asking rents for apartments have fallen 1.2% nationally over the past 8 months, according to popular rental websites. This is because of the tremendous supply that is starting to arrive onto the market in the top 15 cities in the U.S. Construction loans are also far more expensive than they were just 12 months ago and many banks now shy away from development lending altogether. A number of conversion efforts are on hold now because of higher interest rates. What made perfect sense in mid-2022 now just are high risk and not investible for today’s market.

Current interest rates add a huge amount of cost to any project. One architecture firm we are familiar with is working on office conversion projects totaling thousands of potential apartments that have permits, but are delayed while the developers try to land financing. Although more cities are trying to speed up the process, getting permits can take years. Long approval times are particularly brutal when combined with higher interest rates because developers often have to make debt payments while they wait for the green light. That can kill the project.

Even when interest rates are low, repurposing offices can get expensive fast. Many require major interior demolition to make the floor plans work, including extensive plumbing work to add kitchens and bathrooms. Environmental issues, such as asbestos abatement or removing lead paint, also run up costs in older buildings. Moving construction materials through densely built downtowns and in and out of narrow doorways poses other costly hazards.

Amalfi Capital has seized on an opportunity in this space to team up with Foulger-Pratt, a D.C.-based firm to deliver on an office to residential conversion project in one of the hottest markets in the country, Washington, D.C.

Foulger-Pratt has over 60+ years of expertise and has developed more than 15 million SF of multifamily, office and retail assets valued over $5 billion. Since its founding in 1960, Foulger-Pratt has been developing complex office, retail, build-for-rent, and multifamily projects in the D.C. area. FP calls D.C. home and it is the market they know best, allowing the firm to both effectively underwrite projects and deliver them with timely and seamless execution.

Foulger-Pratt has identified a fantastic opportunity to purchase and convert 1425 New York Avenue, a 13-story unique office-to-residential conversion project that will reposition a vacant office building in an unparalleled, supply-constrained location, one block from the White House, into a trophy, Class A+, 243-unit multifamily asset. It will be the closest multifamily building to the White House upon completion, with top-of- market amenities and rooftop views of notable landmarks. Located in the heart of Washington D.C.’s most expensive neighborhood and boasting a Walk Score of 98 and a Transit Score of 100, the Property’s location is perfectly positioned for residents to take advantage of all that the D.C. metro has to offer.

If there is a case for past success, lower Manhattan is it. It offers a model of the possibilities of turning a commercial neighborhood into a partly residential one. Facing financial difficulties in the early 1990s, New York State passed a tax abatement program, called 421-g, encouraging the conversion of old offices into housing. As a result, nearly 13 million square feet, or 13 percent of Lower Manhattan’s office real estate was turned into residential space between 1995 and 2006. A huge undertaking that shows when like-minded people pursue a common goal success is possible.

“We have previously partnered with Foulger-Pratt on a new residential development in the Navy Yard section of D.C. and are extremely excited to be involved in such an incredible opportunity as New York Ave to transform an office property to residential units in what can only be described as the best location in Washington…. less than a mile from the White House. We are partnering with a seasoned and vertically integrated sponsor who has a long history of property development and management in the Washington, D.C. market and who has the know how to take on such a project.” said Raffaella Schnurr, CEO of Amalfi.